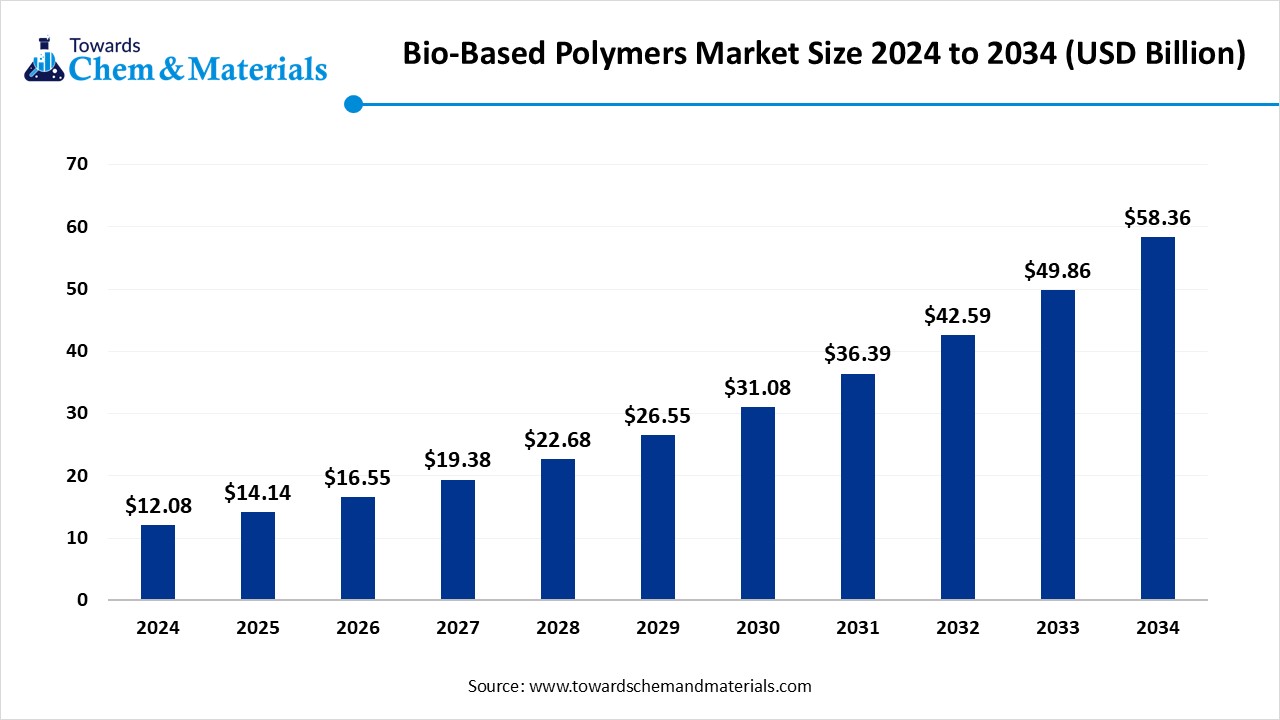

Bio-Based Polymers Market Size to Worth USD 58.36 Billion by 2034

According to Towards Chemical and Materials, the global bio-based polymers market size was valued at USD 12.08 billion in 2024 and is expected to be worth around USD 58.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.06% over the forecast period from 2025 to 2034.

Ottawa, Sept. 05, 2025 (GLOBE NEWSWIRE) -- The global bio-based polymers market size is valued at USD 14.14 billion in 2025 and is anticipated to reach around USD 58.36 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.06% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The market is driven by rising demand for sustainable materials, strict environmental regulations, and advancements in biotechnology, also market expansion, positioning bio-based alternatives as key to future material innovation.

Download a Sample Report Here @ https://www.towardschemandmaterials.com/download-sample/5770

Bio-Based Polymers Market Overview

The bio-based polymers market is made up of polymers that are derived from renewable biological raw materials such as starch, sugar, cellulose, and plant oils so that they can function as a sustainable alternative to conventional non-bio-based petrochemical (fossil) derived plastics. The market is growing because of increasing environmental stewardship as well as regulatory pressures to lower carbon emissions and consumer demand for biodegradable and recyclable materials across packaging, automotive, consumer goods, and textiles. New technologies, corporate behaviour, and government incentives have driven the demand for bio-based polymers.

However, bio-based polymers remain more expensive than non-bio-based polymers and have some performance limitations. Nevertheless, the market represents a strategic investment in the growing circular economy model that emphasizes resource efficiency, efficiency, and a lower ecological footprint.

Bio-Based Polymers Market Highlights

- By region, Europe held approximately a 40% share in the bio-based polymers market in 2024 due to the bans on single-use plastics.

- By type, the polylactic acid segment held approximately a 35% share in the market in 2024 due to the ongoing advancements in PLA production.

- By feedstock source, the plant-based segment held approximately a 60% share in the market in 2024 due to the availability of corn starch and sugarcane.

- By processing technology, the fermentation & polymerization segment held approximately a 50% share in the market in 2024 due to the focus on reducing reliance on fossil fuels.

- By end-use industry, the food & beverage packaging segment held approximately a 40% share in the market in 2024 due to the strong focus on improving fuel efficiency.

- By distribution channel, the direct sales segment held approximately a 55% share in the market in 2024 due to the growing demand for customized solutions.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/price/5770

Bio-Based Polymer Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 14.14 billion |

| Revenue forecast in 2034 | USD 58.36 billion |

| Growth Rate | CAGR of 17.06% from 2024 to 2034 |

| Base year for estimation | 2024 |

| Historical data | 2020 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in Kilotons, Revenue in USD million and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | By Type, By Feedstock Source, By Processing Technology, By End-Use Industry, By Distribution Channel, By Region |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country scope | U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Indonesia, Vietnam, Brazil, Argentina, Saudi Arabia, UAE, South Africa, Kuwait |

| Key companies profiled | Dow, NatureWorks LLC , Braskem , BASF SE, TotalEnergies Corbion bv , Novamont SpA , Biome Bioplastics, PTT Global Chemical Public Company Limited , Mitsubishi Chemical Holding Corporation Biotec , Mapei S.p.A, SOLVAY ,DAIKIN , Toray Industries, Inc. , KURARAY CO., LTD. , Dupont , Plantic |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

What Are the Major Trends in The Bio-Based Polymers Market?

- Movement Towards Biodegradable Packaging – Although economic arguments appeal to the packaging industry, the increased bans on single-use plastics are creating accelerated interest in bio-based packaging for food, beverage and e-commerce packaging.

- Development of Advanced Feedstocks – Non-food biomass, agricultural residues, and waste oils are being increasingly used by the bio-based polymer sector to eliminate the reliance on traditional crops such as corn or sugarcane.

- Technological Developments Driving Performance - The progress of polymer chemistry is advancing the durability and heat, and barrier properties in bio-based polymers thus providing them for other high-performance industries like automotive and electronics.

- Joint Factories/Circular Economy Models - Collaboration is beginning to happen between chemical companies, packaging companies, and retailers to provide closed-loop systems and is driving increased adoption of bio-based materials on a global scale.

Growth Factor in The Bio-Based Polymers Market

Is Growing Demand for Sustainable Materials Driving the Use of Bio-Based Polymers?

One of the largest drivers for the bio-based polymers market is the increased demand for sustainable and eco-friendly materials around the globe as companies start to shift away from petroleum-based plastics. Many corporations and governments have begun adopting green policies, (for example EU directives forbidding the use of single-use plastics, introducing mandatory use of renewable materials, and requiring renewables in packaging).

-

In March 2024, Coca-Cola announced it will be signs that it will be pioneering an expansion of its use of bio-based PET bottles in the U.S. and, Canada to decrease carbon emissions in 2025.

Leading auto manufacturers, such as Toyota and BMW, are adopting bio-based polymers into the interior of their vehicles to reduce their carbon footprint and promote sustainability in the automotive space. Also, many of these efforts are serving as a catalyst for bio-based polymers, which can come from renewable resources or feedstocks, across the packaging, automobile, textile, personal care, and consumer goods industries.

Will Developments in The Field of Biotechnology Be a Catalyst for Progress in Bio-Based Polymers?

A unique prospect within the bio-based polymers market lies in the fast-paced progress of biotechnology and material science. The integration of microbial fermentation, enzymatic conversion, or genetic engineering are emerging platforms to produce new classes of polymers more affordably and with better performance. For example, In July 2024 ZymoChem introduced BAYSE™, the first-ever scalable 100% bio-based, biodegradable super-absorbent polymer aimed to be a sustainable alternative to hygiene products.

Similar partnerships among chemical companies and biotech startups are leading to the creation of bio-based polymers with properties modified for automotive, battery, and electronics applications. Each of these innovations is not only eliminating reliance on a fossil fuel feedstock, but also expanding opportunities for scalability that will catalyze bio-polymers for adoption among industries looking for highly functional, sustainable alternatives.

Limitations And Challenges in The Bio-Based Polymers Market

- High Production Cost- The use of expensive feedstock and complex processing technologies creates a niche product that can be more expensive than conventional plastics. The price gap is a barrier to large scale adoption, especially within cost-sensitive industries, such as packaging and consumer goods.

- Limited Feedstock Availability- There are significant limitations in the feedstock used for bio-based polymers. Food crops like corn, sugarcane, or starch feedstock creates availability issues, including seasonal availability, competing land-use, and food versus fuel debates. This creates barriers to an uninterrupted supply of raw materials used to manufacture bio-based polymers.

- Performance Limitations- Many bio-based polymers can be deficient in durability, thermal resistance, and versatility compared to petroleum-based plastics. These shortcomings can hinder acceptance and utilization in high-demand applications (e.g., automotive, electronics, and construction) where reliability and performance is an important consideration.

Why Europe Is the Dominant Player in The Bio-Based Polymers Market?

Europe dominated the market in 2024. Europe's strength is due to the regulatory framework backing as well as the rapid growth of industrial capacity. There is also a regulatory impetus from the EU's new Packaging & Packaging Waste Regulation (PPWR), effective February 2025, to mandate recyclability, composability labelling, with design provisions directly benefitting bio-based materials. Additionally, typical major investments by industry are continuing to accelerate, with investors demonstrating confidence in the viability of bio-based materials.

-

In November 2024, Futerro obtained its first external funding for a €12 million biorefinery in Normandy, France. With the €500 million investment, the plant will have 75,000 tones of annual PLA capacity, making it Europe´s first fully integrated circular biorefinery. These developments reinforce the notion that Europe is the global anchor for developing and commercialize bio-based polymers.

Germany Market Trends

Germany stands out in the region as a commercialization hotspot. It benefits from a strong chemical industry and a network of packaging manufacturers. Federal programs that support circular economy strategies and fund bio-based innovation projects help boost local adoption. In 2024, Germany was the largest European market for bioplastics production capacity. Companies like BASF and Novamont are expanding partnerships to introduce compostable and drop-in bio-based polymers across packaging and automotive supply chains. With its strong R&D ecosystem and solid industrial infrastructure, Germany turns EU sustainability mandates into scalable, market-ready polymer solutions.

Why Asia Pacific Emerging as The Fastest Growing Region in Bio-Based Polymers Market?

Asia Pacific expects the fastest growth in the market during the forecast period. Asia Pacific is becoming the fastest growth centre due to strict policy regulations and several new manufacturing capacities. China has phased restrictions on non-degradable plastics that are creating clear substitution pathways especially in e-commerce, delivery, and hospitality areas where PLA and PHA are taking hold. Collectively these factors are creating accelerated adoption and lessening supply risks for brands looking to move towards sustainable packaging options throughout the region.

Market Trends in China

China is leading in Asia Pacific’s bio-based polymers market. Nationally applied restrictions on single-use plastics form the basis of a clear demand for certified biodegradable substitutes by replacing single-use plastics across hospitality, retail, and courier sectors. The government’s policy framework states that biodegradable substitutes are allowed, with an emphasis on PLA capacity expansion and launching pilot projects into PHA. For many suppliers, the combination of regulatory strictures and very fluid consumer faced industries are making China the strongest cradle for growth and the most proactive captive by compliance-based contracts from logistics, food service, and e-commerce platforms.

Bio-Based Polymers Market Segmentation

Type Insights

Why did the Biodegradable Polymers Segment Dominates the Bio-Based Polymers Market?

The biodegradable polymers segment dominated the market in 2024, driven by rising environmental awareness, government restrictions on plastic use and waste, and increased adoption and usage in packaging, agriculture, and consumer goods. Biodegradable polymers are preferred over plastics due to their ability to decompose and not negatively impact the environment, making them the most dominant contributor to the market in 2024.

The polylactic acid (PLA) segment dominated the market in 2024, with its vast breadth of applications in packaging, textiles, and consumer goods. PLA is plant-based and biodegradable, so it is the leading alternative to petroleum-based plastics, especially within the food packaging sector. A desire for sustainable alternatives in developed markets, as well as supportive regulations, continues to support PLA's lead in the bio-based polymers market.

Polyhydroxyalkanoates (PHA) segment expected to grow at fastest CAGR during the forecasted period, based on its potential for complete biodegradation, and its uses in medical, packaging, and agricultural purposes. PHA's are attracting a lot of attention, now that companies are investing in scaling production using waste feedstocks. Improvements in fermentation technologies, and regulations in reducing plastic waste, are accelerating PHA's uptake, and the market is sitting there as a segment of growth in the upcoming years.

Feedstock Source Insights

Which Feedstock Source Segment Prevalent In The Bio-Based Polymers Market?

The plant-based feedstocks segment dominated the market, because of their availability and well-established supply chains and applications. Plant-based feedstocks generally come from crops like corn, sugarcane, and cassava. These feedstocks are generally the primary source for producing PLA and other bio-based polymers. Their availability and established processing technologies demonstrated compatibility especially for larger volume applications, will be difficult to beat as the primary raw material segment.

The waste and residues segment is experiencing fastest growth in foreseeable period, because they contribute to sustainability objectives and circular economy policies. A significant opportunity arises from converting agricultural residues, food waste and other food by-products to polymers. This reduces a number of environmental impacts while reducing reliance on crops for bio-based polymer production. The increasing pressure for decreased carbon emissions, and addressing food vs fuel concerns, lends credence to waste derived bio-based polymers.

Processing Technology Insights

Which Processing Technology Segment Is Dominating The Bio-Based Polymers Market?

Fermentation & polymerization segment dominated the market in 2024, primarily for its historic relevance and usage in producing many predominant polymers such as PLA and PHA. These technologies also benefit from mature supporting infrastructure, efficiency, and scalability, making it the fundamental basis for bio-polymer production on a large scale. The continued viability universal applicability of using fermentation to process diverse feedstocks in the manufacture of bio-plastics adds to its leading position in this market.

The enzymatic processes segment will grow at the fastest rate, due to the favorable ecological properties and precision associated with polymer synthesis. Enzyme-based approaches can also reduce energy consumption and chemical usage to fabricate commodity plastics, in accordance with principles of green chemistry. Given the increasing level of money invested in R&D and, further advances in biotechnology, there will be substantial momentum towards using this pathway, especially for specialized areas of interest that have higher sustainability limits.

End-Use Industry Insights

Which End-Use Industry Segment Is Dominating the Bio-Based Polymers Market?

The food & beverage packaging industry segment dominated the market in 2024 as bio-based polymers are being used to a larger extent in bottles and films and containers. The regulatory push for non-use of single-use plastics, along with consumer preference for sustainable packaging, contributes to growth in the food packaging industry. PLA and other biodegradable materials are used extensively in this area due to safety, cost, and industrial composting.

The automotive OEMs segment expects the fastest growth in the market during the forecast period. The segment is supported by OEMs continuing to shift to lightweight and sustainable materials. Bio-based polymers are now utilized in interior components, trims and under-the-hood application. As emission norms tighten and demand for green mobility increases, OEMs are continuing to invest in bio-based solutions for improvement in fuel efficiency, sustainability and better overall performance in vehicle manufacturing.

Distribution Channel Insights

Why Direct Sales Segment Dominates the Bio-Based Polymers Market in 2024?

The direct sales segment is the dominant distribution channel in bio-based polymers market in 2024, due to increasing reliance on long-term contracts and direct supply agreements between manufacturers and end-use industries. These agreements tend to improve quality consistency, control prices and enhance collaboration between producers and buyers, which is especially beneficial in applications such as packaging or auto manufacturing where bulk quantities of goods are purchased.

Online specialty chemical platforms segment is expected to register the highest growth rate in forecasted period, because of the ongoing digitalization of supply chains and increasing preference for combination of speed and convenience when procuring goods. While some of these platforms are more applicable to small to mid-sized (e.g. niche, customized bio-based polymer products) product buyers, they still allow for improved product assurance, more speed in transactions and access to global suppliers.

More Insights in Towards Chemical and Materials:

- Polymers Market : The global polymers market size was reached at USD 796.53 billion in 2024 and is expected to be worth around USD 1,351.59 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.43% over the forecast period 2025 to 2034.

- Medical Fluoropolymers Market : The global medical fluoropolymers market volume was reached at 8.21 kilo tons in 2024 and is expected to be worth around 13.87 kilo tons by 2034, growing at a compound annual growth rate (CAGR) of 5.39% over the forecast period 2025 to 2034.

- Lignin-based Biopolymers Market : The global lignin-based biopolymers market size accounted for USD 1.32 billion in 2024 and is predicted to increase from USD 1.38 billion in 2025 to approximately USD 2.07 billion by 2034, expanding at a CAGR of 8.11% from 2025 to 2034.

- Bio-Based Platform Chemicals Market : The global bio-based platform chemicals market size was reached at USD 29.33 billion in 2024 and is expected to be worth around USD 48.46 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.15% over the forecast period 2025 to 2034.

- Bio-Based Polyurethane Market : The global bio-based polyurethane market size was reached at 4.86 million tons in 2024 and is expected to be worth around 10.73 million tons by 2034, growing at a compound annual growth rate (CAGR) of 8.24% over the forecast period 2025 to 2034.

- Bio-based Solvents Market : The global bio-based solvents market volume was reached at 13,00,000.0 tons in 2024 and is expected to be worth around 25,81,297.5 tons by 2034, growing at a compound annual growth rate (CAGR) of 7.10% over the forecast period 2025 to 2034.

- Bio-based Surfactants Market : the global bio-based surfactants market volume is calculated at 5,96,016.3 tons in 2024, grew to 6,18,664.9 tons in 2025 and is predicted to hit around 8,65,429.5 tons by 2034, expanding at healthy CAGR of 3.80% between 2025 and 2034.

- Bio-based Propylene Glycol Market : The global bio-based propylene glycol market volume accounted for 2,322,157.1 tons in 2024, grew to 2,530,686.8 Tons in 2025, and is expected to be worth around 5,487,311.8 Tons by 2034, poised to grow at a CAGR of 8.98% between 2025 and 2034.

- Bio-Based Textiles Market : The global bio-based textiles market size reached a size of 54.21 billion in 2025, the market is further projected to grow at a CAGR of 8.55% between 2025 and 2034, reaching a size of 113.43 billion by 2034.

- Bio-based Polycarbonate Market : The global bio-based polycarbonate market size is expected to be worth around USD 182.5 million by 2034 from USD 73.98 million in 2024, growing at a CAGR of 9.45% during the forecast period 2025 to 2034.

- Bioresorbable Polymers Market : The global bioresorbable polymers market volume accounted for 1,121.0 kilotons in 2024 and is predicted to increase from 1,267.9 kilotons in 2025 to approximately 3,839.1 kilotons by 2034, expanding at a CAGR of 13.10% from 2025 to 2034.

- Polymer Denture Material Market : The global polymer denture material market size was USD 2.35 billion in 2024 and is projected to grow from USD 2.49 billion in 2025 to USD 4.11 billion by 2034, exhibiting a CAGR of 5.75% during the forecast period.

Bio-Based Polymers Market Top Key Companies:

- Dow

- NatureWorks LLC

- Braskem

- BASF SE

- TotalEnergies Corbion bv

- Novamont SpA

- Biome Bioplastics

- PTT Global Chemical Public Company Limited

- Mitsubishi Chemical Holding Corporation

- Biotec

- Mapei S.p.A

- SOLVAY

- DAIKIN

- Toray Industries, Inc.

- KURARAY CO., LTD.

- Dupont

- Plantic

Recent Developments

- In June 2025, HH Chemical launched BIODEX®, the first fully integrated bio-based materials brand, covering monomers, elastomers, polymer chips, fibers and fabrics. It provides greener, softer, elastic solutions, achieving 73% less CO2 emissions compared to nylon polymers.

- In March 2025, Lactips introduced CareTips® PFP344MAX, a 100% bio-based, compostable sealant formulated from natural polymer granules. It’s PFAs-free, recyclable, home-compostable, and is ideal for dry food and secondary packaging applications due to its excellent sealability.

-

In April 2025, BASF launched Verdessence® Maize, a new plant-based styling polymer derived from hydrolyzed corn starch that provides a biodegradable alternative to the conventional PVP/VP-VA polymers in continous use for styling products, and it is ideal for use in alternative to transparent sprays or calculating novel cloud-foam mousses in the personal care market.

Bio-Based Polymers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Bio-Based Polymers Market

By Type

- Biodegradable Polymers

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch-Based Plastics

- Polybutylene Succinate (PBS)

- Non-Biodegradable Bio-Based Polymers

- Bio-Polyethylene (Bio-PE)

- Bio-Polyethylene Terephthalate (Bio-PET)

- Bio-Polypropylene (Bio-PP)

- Bio-Polyamides (Bio-PA)

By Feedstock Source

- Plant-Based (corn, sugarcane, potato, cassava)

- Cellulose & Wood-Based

- Algae-Based

- Waste & Residue-Based

By Processing Technology

- Fermentation & Polymerization

- Enzymatic Processes

- Chemical Synthesis from Bio-Based Monomers

- Blending with Conventional Polymers

By End-Use Industry

- Food & Beverage Packaging

- Retail & E-Commerce

- Textile & Apparel

- Automotive OEMs

- Agriculture & Horticulture

- Healthcare

By Distribution Channel

- Direct Sales (B2B)

- Resin Distributors

- Online Specialty Chemical Platforms

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5770

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.